Understanding the Difference Between HMO, PPO, and EPO Plans

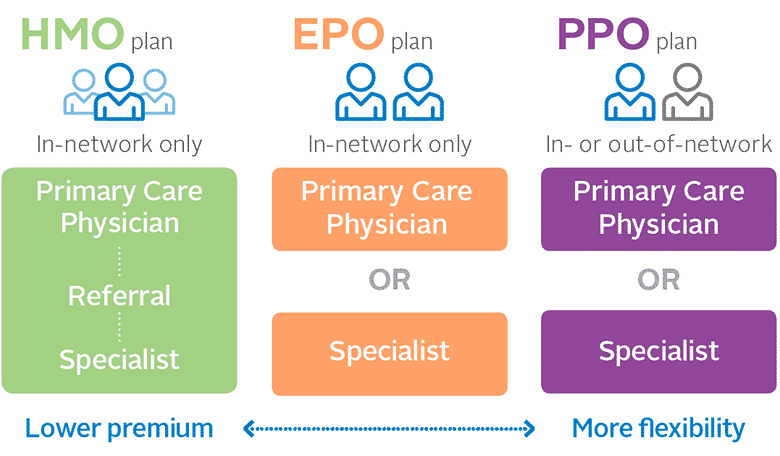

When it comes to choosing health insurance, understanding your options is crucial. Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), and Exclusive Provider Organization (EPO) plans are the most common types available. Each has its unique features, and knowing the differences can help you pick the right plan for your needs.

What is an HMO Plan?

A Health Maintenance Organization (HMO) plan typically requires you to choose a primary care physician (PCP). Your PCP will manage your healthcare, including referrals to specialists. With an HMO, you must stay within the network of doctors and hospitals unless it’s an emergency. The upside is that HMO plans often have lower monthly premiums and out-of-pocket costs.

However, the trade-off for lower costs is the lack of flexibility. If you need a specialist, you will need a referral from your PCP. This can sometimes slow down the process of receiving specialized care.

Read Also: Anavar What Are The Health Benefits Of Anavar 50 mg And How To Use It?

What is a PPO Plan?

A Preferred Provider Organization (PPO) plan offers more flexibility. Unlike an HMO, you don’t need a referral to see a specialist, and you can see any doctor, whether they are in-network or out-of-network. However, visiting out-of-network doctors will cost more.

PPO plans generally have higher premiums than HMOs. But they are ideal if you want more control over your healthcare choices. You can directly visit specialists, which may be faster when you need specific treatments.

What is an EPO Plan?

An Exclusive Provider Organization (EPO) plan is a mix of HMO and PPO features. With an EPO, you don’t need a referral to see a specialist, similar to a PPO. However, like an HMO, you must use in-network doctors and hospitals unless it’s an emergency.

EPO plans to offer a balance between cost and flexibility. They are often more affordable than PPOs, yet provide more freedom than HMOs. But, since there’s no out-of-network coverage, choosing this plan means you must be sure your preferred doctors are within the network.

Key Differences

The biggest difference among HMO, PPO, and EPO plans is the balance between cost and flexibility. HMO plans are the least flexible but the most affordable. PPOs are the most flexible but come with higher costs. EPOs fall in the middle, offering some flexibility but requiring in-network care.

When deciding between these options, it’s important to consider your healthcare needs. If you rarely need specialists and prefer lower costs, an HMO might be best. If you want the freedom to see any doctor, a PPO is likely a better fit. EPO plans work well if you want some flexibility without the high costs of a PPO.

Choosing the Right Plan

The right plan depends on your health needs and budget. It’s always smart to review your network of doctors, how often you need care, and your monthly premiums. Marketplace health insurance offers all three types of plans, so it’s easy to compare options.

Remember to review your plan’s details carefully to avoid unexpected costs. Whether you prefer a low-cost HMO or the freedom of a PPO, understanding the pros and cons of each plan can guide you to make an informed decision.

Conclusion

Picking the right health insurance plan is a personal choice. By knowing the differences between HMO, PPO, and EPO plans, you can better align your healthcare needs with your budget. Be sure to weigh the flexibility, cost, and network options of each plan. In doing so, you’ll be well-equipped to choose the plan that works best for you.